Reverse Mortgage - MMC Lending for Dummies

Top Guidelines Of This letter pertains to a Reverse Mortgage from Wells Fargo, I

The title of the home is in the customer's name, so they are accountable for real estate tax, energies, maintenance, and any other expenditures. In truth, if you do not pay your real estate tax, your lending institution might need you repay your loan in complete. Some loan providers might reserve a part of your loan each year to be used to pay taxes and insurance coverage.

How to keep the home after the death of a spouse who got a reverse mortgage - Las Vegas Review-Journal

During and after the reverse home loan, the house stays in the house owner's name. In this way it resembles traditional forward mortgages. Can you still leave your house to your heirs? Yes, but they will need to repay the loan balance before the title is complimentary and clear.

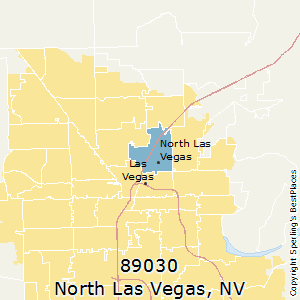

If they sell the house, they will have to pay either the balance of the loan or 95% of the home's evaluated worth (whichever is less). If you're interested in acquiring or re-financing a house in Las Vegas or accross Nevada, Mann Mortgage can assist you make it take place. Please call us today or apply online in less than 10 minutes using the safe and secure online application below.

Reverse home loans have ended up being the cash-strapped homeowner's monetary preparation tool of option. The first Federal Housing Administration-insured reverse home loan was introduced in 1989. Found Here make it possible for senior citizens age 62 and older to access a part of their house equity without needing to move. Reverse mortgage: What is it? A reverse home loan is a kind of home equity loan for older homeowners.

NMP National Mortgage Professional June 2020 by ambizmedia - issuu

The 8-Second Trick For IM-Silver-051308-10094.pdf - Nevada Legislature

The loan is repaid after the borrower moves out or dies. Likewise understood as a home equity conversion home loan, or HECM. Who would benefit Steven Sass, program director at the Center for Retirement Research at Boston College, states a reverse mortgage makes good sense for people who: Do not plan to move.

Reverse Mortgage

Wish to access the equity in their house to supplement their earnings or have money available for a rainy day. Some people even use a reverse mortgage to eliminate their existing home mortgage and improve their month-to-month capital, says Peter Bell, president and CEO of the National Reverse Mortgage Lenders Association.